Market Timing

Check out a sampling of our market timing related communication.

Year 2017-18

WE SAVED THE ENTIRE MARKET FALL / CORRECTION FOR OUR INVESTORS IN 2017-18 !!!

- We quit equities in 2017 as we were highly uncomfortable with the valuations.

- We stayed in Liquid Funds till Sept 2018 till markets saw decent time & price correction.

- More importantly, we didn’t add anything to equities near peak valuations.

- We switched back from Liquid funds to Equity funds in Oct 2018 when broader markets (Mid & Small caps) had seen huge 20-40% correction.

- We saved / generated 9% gap for our investors by 'Selling High' and successfully 'Buying Low'.

- This was our 7th successful 'Market Timing' in past 19 years.

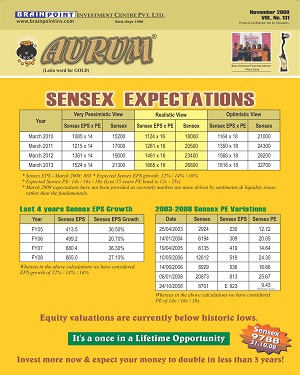

Year 2010 @ Sensex 21000

When Sensex was once again near 21,000 we again switched 100% of our Investors Equity MF Portfolios to Liquid Funds & successfully re-entered lower on 3.2.11.

Dec 2008 - Mar 2009 (Sensex 8200-10000)

Communication sent on 23/02/2009

STRONGLY RECOMMENDED!

Take full advantage of 8850 sensex level.

Invest TODAY in our latest recommended Equity Funds - FUTURE WINNERS.

For tax saving investments under section 80C invest in our recommended ELSS scheme today.

Now start Equity SIP's for sure.

IT’S A SCREAMING BUY NOW BELOW SENSEX 8850.

Don't Miss Now!

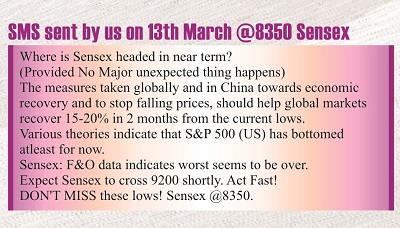

Communication sent on 13/03/2009

Where is Sensex headed in near term?

(Provided No Major unexpected thing happens)

The measures taken globally and in China towards economic recovery and to stop falling prices,

should help global markets recover 15-20% in 2 months from the current lows.

Various theories indicate that S&P 500 (US) has bottomed atleast for now.

Sensex: F&O data indicates worst seems to be over.

Expect Sensex to cross 9200 shortly.

Act Fast! DON’T MISS these lows! Sensex @8350.

We timed the markets almost perfectly for you...

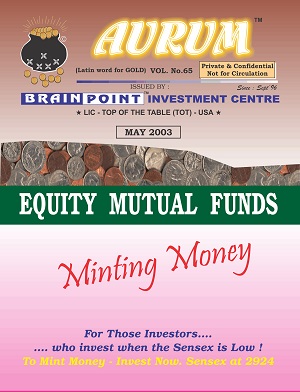

We recommended investing at the start of the rally. (May '03)

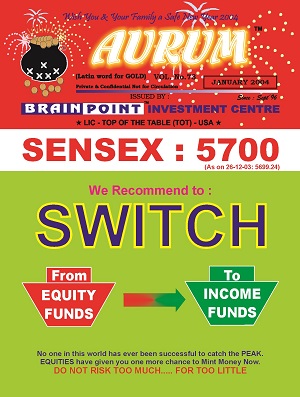

We suggested to quit at the 1st peak. (Jan '04)

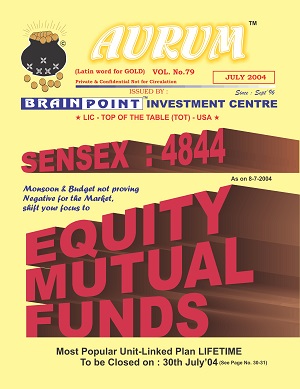

After the fall of NDA Govt. (Jul '04)

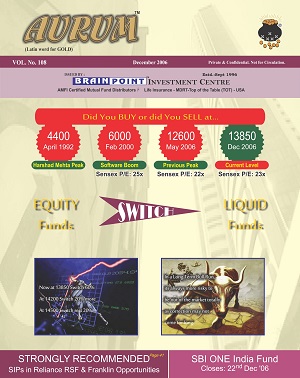

We motivated you to invest during correction. (Jun'06)

We predicted the peak again. (Dec '06)

We motivated you to invest again during the correction. (Mar '07)

We predicted the peak again. (July '07)

We recommended quitting equities from 18000 to 21000 levels. (Nov '07)

We encouraged investors to keep accumulating low. (Nov '08)

We strongly recommended to buy between 8200-9000 levels. (Apr '09)

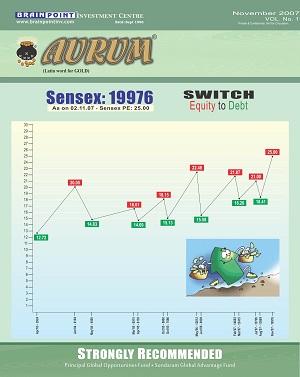

Oct - Dec 2007 (Sensex 18000-21000)

Snippets from our monthly magazine Aurum

AURUM: Oct '07

So to conclude, though the liquidity has pushed the valuations ahead of fundamentals, US & political uncertainty may lead to huge volatility in the markets for next few months. To switch out gradually from Equity to Debt funds temporarily may prove wise.

AURUM: Nov '07

Dizzy Heights - Action Plan at 20000

The word 'risk' seems to have evaporated somewhere in thin air. In Aug '07 when the markets were in

correction phase, all sorts of negative news made lot of sense to all - subprime, political uncertainties,

crude oil, falling dollar, etc. The sentiment was very negative. All the above mentioned negatives are

very much still there. Subprime problems don't seem to be getting over atleast in the near future.

Crude oil has touched life high of $96. Dollar continues to fall. What has changed is only 'sentiments' -

and that too just because we are experiencing a sharp rally over last 2 months. If India's good corporate

results & roaring GDP figures is the reason for the last 6000 point rally in 2 months, I think since last

4 years India's results & GDP numbers are buoyant quarter-on-quarter. So again, nothing has changed in

last 2 months, its only sentiments due to rising markets because of massive liquidity.

AURUM: Dec '07

Anxiety to be in the stock market now seems to be at its peak. Investors want to buy into Equity Mutual Funds and midcap stocks which are rallying since last few weeks. Investors are ready to take on short term correction promising that they are long term investors. Good that Indian investor is now much more brave & thinking long term. I hope if & when markets correct, these investors continue to invest more at lower prices. But normally what happens is different. In my 11 years of experience when the markets correct, 80% of investors don’t buy & another 10% investors actually offload their equity investments. So my experience says 90% investors are momentum investors who follow market trends & fall prey to Greed-Panic syndrome. Only 10% investors actually are long-term investors who invest heavily only when risk-return ratio is favourable and show immense patience & restrict themselves from buying when markets are heated up.

We once again saved huge erosion of our esteemed investor's wealth by quitting equities near peak levels before the crash.

Money is made more due to understanding rather than information.

MAY 1999

INFOTECH BOØMB (Article from our Monthly Magazine AURUM - May 1999)

Should we call it a 'Boom' or a 'Viral Fever'. It's a fact, people have sold out their investments in real quality stocks & shifted to software stocks. The prices have already risen by 10-15 times in last 18 months for the software industry. The question here is: Should we book profits or wait longer?

The answer is obvious. Every individual should ask himself just one question: Whether this price for a particular scrip is logical?

And yes if you have purchased something which you have realized now that it's not at all a software company should be immediately sold whether at profit or loss. It's a fact that more than 10-12 companies (mainly NBFCs) in last 6 months have re-named themselves so as to give a wrong indication that they are a software company.

One really fails to understand how such things are allowed in our country.

Its always wise to book profits at higher levels and collect it again at lower levels. There's a saying "Never Marry Shares".

Many NBFCs even offered rights and bonus during those days. Will the history repeat itself again and now in software sector? Book your profits, otherwise your profits will remain only on paper and won?t be a reality ever.

We saved huge erosion of our esteeemed investor's wealth by quitting infotech funds before the crash. (Ketan Parekh Scam)